|

|

|

|

|

PCE

Departments

USDA Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Billionaire Paul Singer Just Sold This Chip Stock. Should You?Billionaire investor Paul Singer, through his hedge fund Elliott Management, completely exited its position in Arm Holdings (ARM) during the second quarter of 2025, as disclosed in a regulatory filing. Simultaneously, the fund initiated a substantial new put option on Hewlett Packard Enterprise (HPE), betting long on approximately 18.6 million shares. Elliot Management also increased its holdings in Phillips 66 (PSX) and other names. Singer’s move away from Arm after previously holding a position suggests a strategic realignment within Elliott’s broader portfolio. Whether this indicates diminished confidence in Arm’s near-term trajectory or simply reflects a reallocation toward sectors like enterprise IT is not clear. But should you follow this move? Let’s discuss. About ARM StockArm, headquartered in Cambridge, UK, is a prominent British semiconductor and software design firm that specializes in developing energy-efficient CPU cores, GPUs, NPUs, SoC infrastructure, and associated tooling. The company remains a majority-owned subsidiary of SoftBank Group and deployed its technology across virtually all modern smartphones, infrastructure, automotive, and IoT devices. Arm’s market cap stands at approximately $141 billion, reflecting a substantial increase from prior years and underscoring its value and influence within the semiconductor sector. ARM has seen a remarkable ascent since its late-2023 IPO, nearly tripling in value from around $51 to its last closing at $134.01. On a year-to-date (YTD) basis, the stock is up 5%, buoyed by favorable analyst commentary and expansion into data center and automotive markets. However, shares tumbled post-earnings and are down 18% over the past month due to softer-than-expected guidance and the company’s strategic pivot toward chip manufacturing, which introduced uncertainty. ARM currently trades at a rich valuation compared to the sector median at 158.63 times forward earnings.

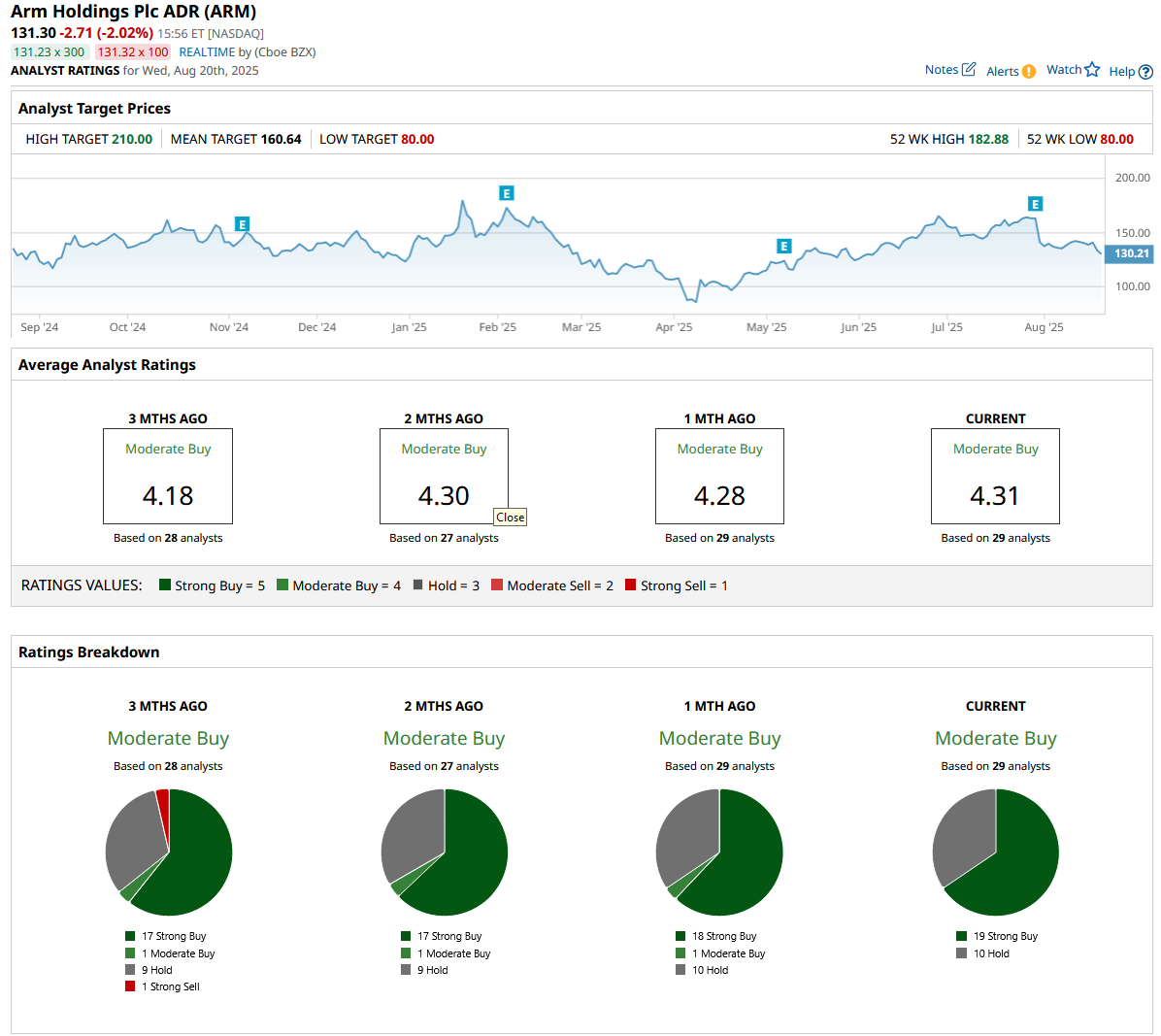

Arm Holdings Reported Steady Topline GrowthArm reported its first quarter of fiscal year 2026, for the period ending June 30, 2025, with results released after market close on July 30. The company posted $1.05 billion in revenue, reflecting a solid 12% year-over-year (YoY) increase, marking its second-best revenue quarter and best Q1 revenue quarter. Its adjusted EPS came in at $0.35, compared with $0.40 in the same period a year ago. Royalty revenues were a standout, rising 25% to about $585 million, underpinning strong demand across AI, automotive, and data-center applications. Looking forward, the company provided Q2 guidance of $0.29 to $0.37 EPS and $1.01 billion to $1.11 billion in revenue, which was below expectations and tempered sentiment. Concurrently, Arm signaled a bold strategic pivot, expanding into chip development itself, a move that could redefine its traditional licensing model but also carries competitive implications. Investors responded cautiously to the outlook and evolving strategy, underscoring heightened sensitivity with the stock plunging. Analysts covering ARM predict EPS to be around $0.89 for fiscal 2026, down 16% YoY, before improving by 68.5% annually to $1.50 in fiscal 2027. What Do Analysts Expect for ARM Stock?Recent analyst activity around Arm has featured a mix of upgrades, positive initiations, and recognition, painting an overall optimistic picture. Seaport Global, led by analyst Jay Goldberg, initiated coverage on Arm Holdings with a “Buy” rating on Aug. 11 and set a $150 price target, drawing strong investor attention to the semiconductor company. The firm sees Arm as revitalized, with strong positioning in data centers and expanding opportunities in the automotive sector. On July 31, Morgan Stanley analyst Lee Simpson maintained an “Overweight” rating on ARM but cut the price target to $180 from $194, reflecting a 7.2% reduction and signaling a more cautious outlook despite overall confidence in the stock. ARM stock has a consensus “Moderate Buy” rating overall. Out of 29 analysts covering the tech stock, 19 recommend a “Strong Buy,” while 10 analysts stay cautious with a “Hold” rating. The average analyst price target for ARM is $160.24, indicating a potential upside of 20%. The Street-high target price of $210 suggests that the stock could rally as much as 46%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|